How does including in-store sales change how you evaluate your ad campaigns? A lot, actually.

Walmart Connect recently rolled out the ability to tie digital ads to in-store sales. Essentially, that means you can see how many people viewed your ads online and then later made a purchase in store.

At Intentwise, we quickly incorporated this feature into our Walmart Ad Optimizer, where it is available to all of our customers who sell in physical Walmart stores.

But we still had some questions about it. Basically: We knew this was a big deal, but we didn’t have a sense of how big that pool of shoppers that makes in-store purchases after seeing digital ads really was.

We decided to investigate.

Why does Walmart in-store attribution matter?

This Walmart Connect update is so exciting because it actualizes the promise of omnichannel data.

Omnichannel—the idea that the e-commerce and in-store sides of your business are interconnected—has been a buzzword in the industry for years. But now, the term is getting real teeth.

The average brand is finally able to build a portrait of what those connections between digital and in-store actually look like.

For example, now you can know: Are shoppers starting their search online, and then getting in the car to go on errands in person?

Are they adding your products to cart and then going out and buying them in a store, so they don’t have to wait for a shipment to arrive?

Or maybe digital ads influence physical purchases more subtly. A Walmart shopper sees your ad while browsing online, then later that week happens to be in a Walmart store.

They notice your product on the shelves, and because they already had that first touchpoint, they are more likely to make that purchase.

All of these things are happening, of course—but how big is this cohort of digital to in-store shoppers?

How in-store attribution increases ROAS

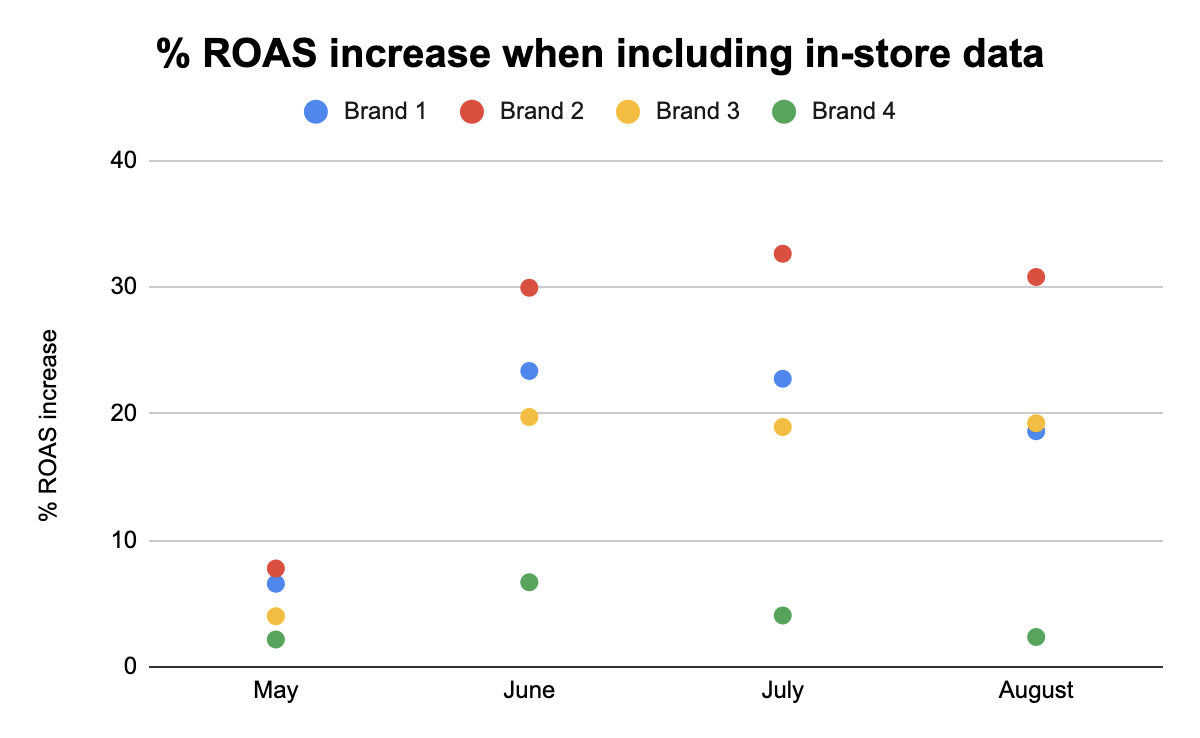

We wanted to understand how much our understanding of performance would shift when we included in-store sales. So we decided to put our data to the test.

In our platform, we compared Omnichannel ROAS—which includes all ad-attributed sales made both online and in-store—against our regular ROAS figure, which only measures digital sales.

We decided to track by what percentage ROAS increases when you include in-store data.

We found that, when you factor in in-store sales, the ROAS on your Walmart Connect campaigns typically increases by about 20%.

That’s a big number.

To illustrate it, here’s an example from the last few months, across 4 brands:

As you can see in the chart, the scale of the ROAS change depends a lot on the brand. Brand 4 didn’t see their ROAS increase by more than 10% when factoring in in-store sales.

Brand 2, by contrast, regularly saw its ROAS increase by 30% when in-store sales were added in.

A 30% increase in ROAS is a massive shift. That can mean the difference between an ad campaign strategy that you deem successful and one that you decide to abandon.

Basically: Adding in-store attribution tells you that your ads are going further than you had thought.

Plus, in our platform, you can easily get more granular than that.

Are certain keywords driving a disproportionate share of in-store sales? Do certain products have a lot more ad-attributed in-store sales than others?

You can quickly see how your Omnichannel ROAS changes based on the specific product or the keyword type, for instance.

Getting this data also lets you spot opportunities that your competitors might miss. If you know that certain keywords are driving a lot of in-store sales, then those keywords might suddenly look a lot more promising than when you just counted digital sales.

Up the spend on them, and you might help yourself stand out in Walmart physical stores, too.

Who benefits the most from in-store sales?

As we saw by looking at our own data, not every brand has the same swings in ROAS when in-store sales are added. We suspect that certain categories of products are likely to have more ad-attributed in-stores sales than others.

This is especially likely for products with an urgency attached: Think of groceries or health products, for example, where you often want them the same day.

There likely is a segment of customers who search for products on Walmart.com, just to see what they have, before driving over to a physical store and making those purchases.

If they need the product day of, they don’t want to wait for shipping.

So these lessons might apply more to some brands than to others—but, if you sell in Walmart stores, you should at least get a sense of what the picture looks like for your brand.

What if I don’t sell in store?

Obviously, many people reading this probably don’t sell their products in physical stores. But there is a lesson here for you even if you don’t.

Customer journeys are complex and far more interconnected than you might think, and you need to connect together the data from all of your channels in order to understand it.

Even if you don’t have an in-store presence, you might have a DTC presence. Consider measuring shopper overlap in a different way, by tying together your DTC and in-store data, for instance.

Or if you sell in store, but just not on Walmart, Amazon itself is looking into tying together in-store and digital attribution with its NCS CPG Insights Stream.

The future of the business is unifying shopper behavior across all of these channels.

![[Walmart] Blog Post [Walmart] Blog Post](https://www.intentwise.com/blog/wp-content/uploads/elementor/thumbs/Walmart-Blog-Post-qsuar96lx1wesdnaytq1m2sfggt5xblef6wck8p1s0.jpg)