Marketers are eagerly building ways to track their shopper journeys across multiple channels.

That was one of our big takeaways from Prosper Show 2024, which our team attended last week. AI was a major talking point of the conference, of course, but we were especially drawn to the discussion about how best to analyze data across channels.

Here’s what we noticed. Especially as the e-commerce landscape becomes more diffuse, brands are waking up to the fact that their DTC sites don’t exist in isolation from third-party sites like Amazon and Walmart.

It’s not just because of the increasing prominence of Buy with Prime. An ad campaign on one platform tends to lead to sales increases on the others, too.

Brands now have lots of data streaming in from across channels, and they want to figure out the best ways to use it to, say, calculate profitability.

At Prosper, some of the major keynotes advised marketers on:

- How to convert their social media followings into shoppers

- How to expand their presence from digital sites into brick-and-mortar stores

- How to make the most of Walmart Connect, TikTok Shop, and other up-and-coming retail media platforms

The reality is, shoppers are not just browsing your listings on Amazon. They’re also visiting your DTC site, searching on Walmart, and making impulse purchases on TikTok Shop.

With so many channels to manage, how do you create a 360-degree view of your business? How do you see profitability and Customer Long-Term Value across all of your channels?

It’s a difficult task. But with a few savvy tricks, you can get pretty close to a 360-degree view of your shoppers anyway.

What does a connected shopper journey look like?

Let’s take a simple example—ad campaigns.

It’s easy to examine the ROAS on a single ad campaign and make a quick judgment about the effectiveness of that campaign. But often, examining ad campaigns in isolation doesn’t tell the full story.

The truth is, none of your ads exists in a vacuum. An awareness-focused DSP ad campaign might have a low ROAS, for example, but if you connect that DSP campaign to your other ads, you might find that it actually pushed a lot of shoppers down the funnel.

In other words, a connected view of your ads allows you to see that the campaign was actually a winner.

Take that same logic, and extrapolate it out to your other tactics. How are your social media strategies informing your Amazon sales? How is your digital presence influencing your in-store sales?

Today, there are more and more ways to find out.

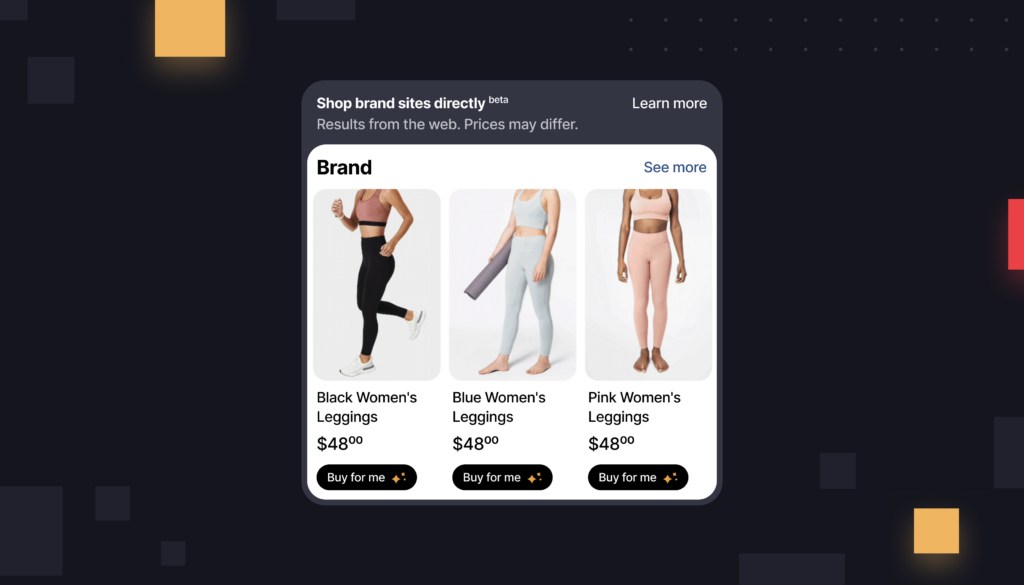

Track the effectiveness of social traffic. Let’s say you’re investing heavily in social platforms like Instagram and TikTok. You want to make sure your offsite traffic to Amazon converts nearly as highly as your on-platform traffic.

Luckily, Amazon offers a measurement tool called Amazon Attribution—which is also available through Intentwise—that lets you study off-Amazon traffic by channel.

Which groups, once they land on your Amazon page, are converting the highest? Which platforms are worth your effort?

Now you can measure the effectiveness of your social media and email strategies.

Connect digital and in-store sales. Platforms like Walmart Connect help you tie together your digital and in-person sales. Push ads out to people who buy from you both in-store and online, and track how they convert across both channels. Select brands can use Walmart Connect to link a shopper’s digital and in-store interactions with their brand. That way, you get a full view of their performance.

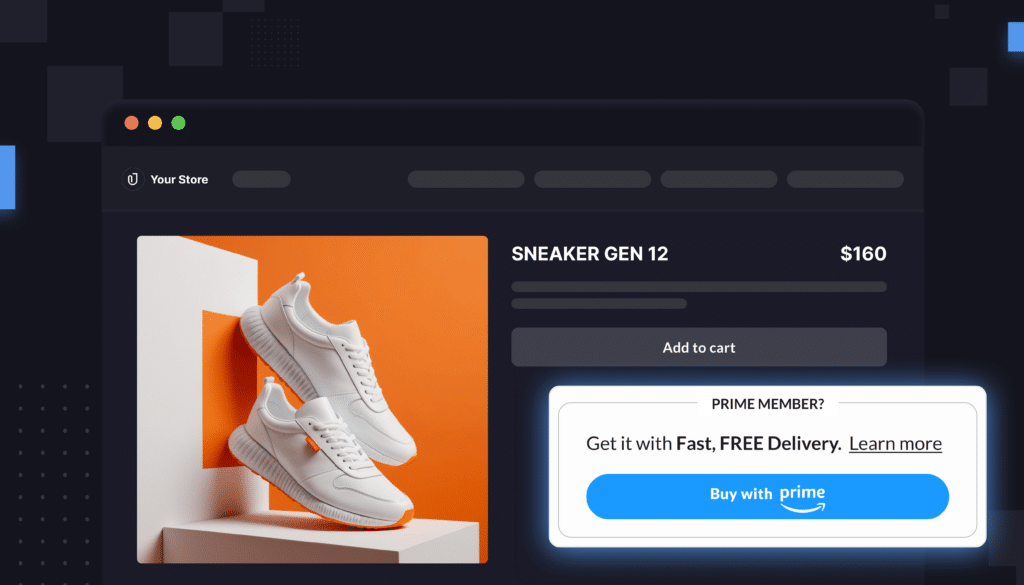

Layer on 1P data. For a long time, it was impossible to get a full view of the customer journey. Brands that operate a DTC site probably knew that their DTC channel has some overlap with Amazon.

Shoppers often bounce between both platforms, and an ad campaign focused on one can benefit the other, too. But it’s been impossible to see how those overlaps happen—until now.

Amazon Marketing Cloud now lets you upload your 1P data directly in a secure, privacy-safe way. AMC then matches your DTC shoppers to the user_ids of Amazon’s shoppers.

The end result is that you can see the whole customer journey:

- Do your Amazon shoppers also buy from your DTC site?

- If so, which products do they buy on each platform? Are there important patterns?

- Does Customer Long-Time Value vary meaningfully between Amazon vs. DTC?

You can also use this new data to make your ad campaigns more efficient. Say you want to avoid running ads through Amazon DSP to your DTC shoppers, so you don’t cannibalize sales. That’s easy. Just create an audience of DTC shoppers in AMC, and exclude them from your next DSP campaign.

(For what it’s worth: Intentwise is now opening up our beta test of 1P data uploads. Sign up here to get it first.)

How to craft your multi-channel data strategy

If you’re interested in seeing a connected view of your ads and of your cross-platform shoppers, Amazon Marketing Cloud is your best bet. As our CEO Sreenath Reddy outlined in his keynote at the Prosper Show, AMC is the only platform that lets you see your shopper touchpoints in tandem.

How many ads do your shoppers see before they purchase from you? Does the order in which they see those ads matter? What actions do shoppers take before they Subscribe & Save? And how does your DTC site factor in?

AMC helps you answer these questions. (Learn how in our in-depth whitepaper on AMC.)

If you’re not using AMC, however, there are other ways to bring together all of your data. Visiting our Data Strategy Learning Hub can give you a good place to start, if you’re looking to calculate profitability or Customer Long-Term Value across channels.