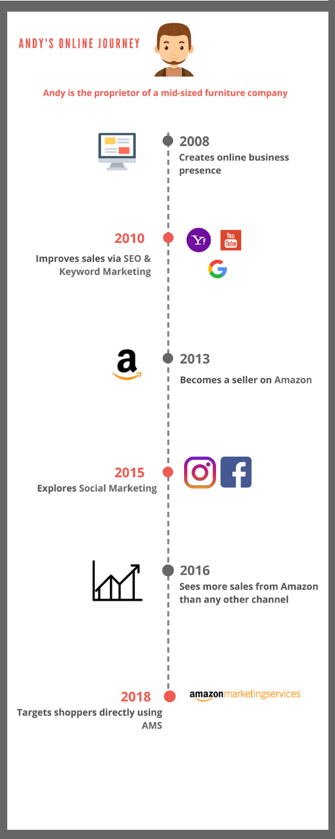

Andy is the proprietor of a mid-sized furniture company. Back in 2010, he wasn’t a listed vendor/seller on any online marketplace. His efforts to drive traffic to his website were restricted to paid keyword marketing on Google and Yahoo. Today, he is a vendor on Amazon and is faced with multiple choices offering him better opportunities to drive conversion and sales. This is where most businesses find themselves currently. How they make informed choices, focus and take control of their marketing strategy becomes crucial for their success.

Andy is the proprietor of a mid-sized furniture company. Back in 2010, he wasn’t a listed vendor/seller on any online marketplace. His efforts to drive traffic to his website were restricted to paid keyword marketing on Google and Yahoo. Today, he is a vendor on Amazon and is faced with multiple choices offering him better opportunities to drive conversion and sales. This is where most businesses find themselves currently. How they make informed choices, focus and take control of their marketing strategy becomes crucial for their success.

A few years ago, Google used to be the primary ‘go-to’ platform to find products online. Every business targeted being found on the first page of Google and perhaps being on top of the search results page. Investing in AdWords was a sure-shot way of making it to the top of the search results page. Although, Google still dominates paid search, according to eMarketer, Amazon is a growing digital ad powerhouse with rapidly increasing revenues that currently rank it 5th among all US ad firms. For product-related searches, Amazon is catching up with Google. It has a larger reach compared to other online retailers in the US or traditional digital ad publishing giants like Google and Facebook.

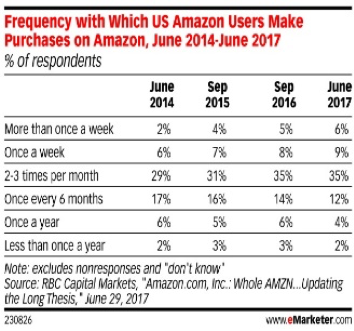

Shoppers on Amazon have a high likelihood to buy from the site and this promises better sales conversion. Coupled with frequent purchases, spend by customers has also gone up. If this isn’t sufficient incentive, Forrester found in 2012 that 30 percent of consumers research products on Amazon first. However, as of 2017, Amazon was a close second to Google in the ranking of sites used to find and research products. This continues a more than three-year growth trend for Amazon, suggesting that their share of product searches will continue to grow. Such real-time data on consumer behavior is a treasure trove to marketers.

Amazon’s advertising platform enables sellers to promote their products and drive sales but not all of them are available to every seller. Therefore, it is important to understand the difference between first-party seller (vendor) and third-party seller to make informed decisions. First party sellers (or Amazon vendors) sell their supplies in bulk to Amazon, there is a transfer of product ownership from the vendor to Amazon. Amazon Vendor Central is the interface used by 1P sellers. You can tell by the phrase “ships from and sold by Amazon” that the product is being sold through Vendor Central. You can only become a vendor by invitation. On the other hand, third-party sellers sell their inventory to Amazon customers through the platform and the product ownership moves to an Amazon customer (when purchased). In this case, Amazon doesn’t have ownership over the seller’s products, even in the case of Full-fillment by Amazon. The platform just works as an intermediary. 3P sellers use the Seller Central interface.

The retail behemoth has numerous media prospects ranging from headline search ads to sponsored products, display and video. Amazon is also growing potential ad catalog through its electronic devices (Echo, FireTV). The retailer’s secret sauce is, it already has an established relationship with small and medium-size business owners and they are the ones that can benefit from advertising with Amazon. The most profitable offering from Amazon’s ad tech stack is Amazon Marketing Services (AMS). AMS is a collection of self‐service paid ad products targeting the small and medium brand owner market segments.

There are three ad formats on a cost-per-click basis:

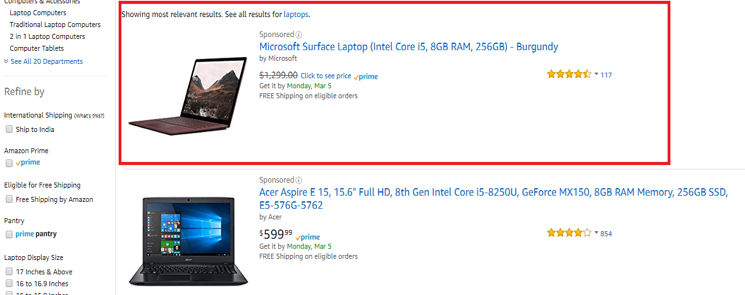

Sponsored Products Ads

These Ads are easy to create and are available to both (3P) sellers and (1P) vendors. It helps you display your ads at the top, right side and bottom of the search results page. This type of ad is driven by “manual keyword targeting” or “automatic keyword targeting”. Manual keyword targeting is similar to other PPC platforms and you can choose the relevant keywords for your audience. Whereas, for auto-targeting, Amazon’s search algorithm does all the work in finding the right keywords for your campaign. You can monitor the performance of each keyword, adjust bids, add or delete keywords with Amazon campaign manager and check AMS reports to find out which ones converted to sales.

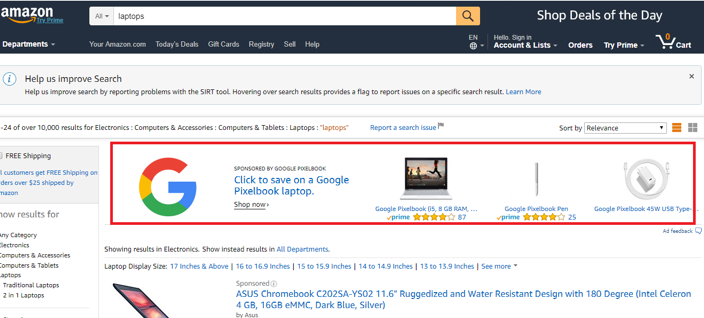

Headline Search Ads

These ads are keyword-driven ads that appear above search results. You can use the keyword traffic indicator to get potential keywords as well, set a bid per keyword and track results. This format allows you to include three products in one ad and customize it. You can test and learn which ad gets you the best results. This requires daily monitoring, as you need to check each keyword bid and determine the “win rate”. Amazon recommends choosing medium and low traffic keywords as they up your chances of winning the competition than popular ones.

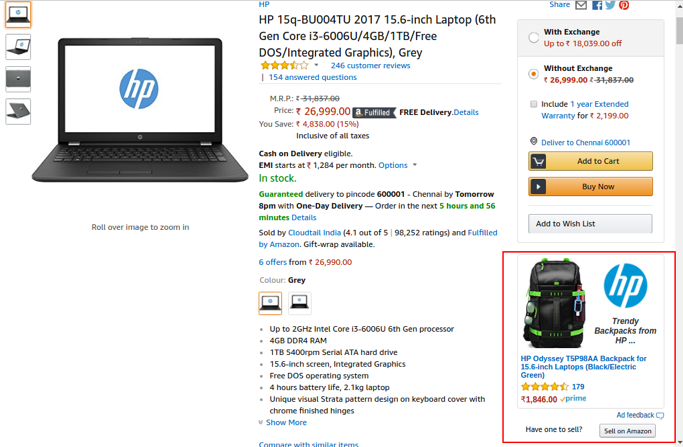

Product Display Ads

These ads are only available for on Vendor Central and Vendor Express, Product Display Ads are typically displayed on product detail pages below the Buy Box and the “other sellers” section. This ad format can be based on the buyer’s interest or be product-driven. This provides you an opportunity to up-sell and cross-sell, depending on whether you choose to target a set of products or interest groups. The former has better conversion, while the latter offers a better reach. These ads run across desktop and mobile detail pages.

In July 2017, ClickZ Intelligence and Catalyst found that 82% of business-to-consumer (B2C) marketers in North America who advertised on Amazon used Sponsored Products placements, while about two-thirds used each of the other two AMS products. Larger brands engage with the managed services team, Amazon Media Group (AMG) and look for both branding and performance marketing. Unlike Google shopping ads that take you to the advertiser’s site, Amazon routes the user to the product details page thus ensuring the user never leaves Amazon site. The level of control on AMS is better and pricing is more affordable.

Amazon is a conversion-focused platform and what it means for a seller is that, if a product does not perform well, it can become ineligible for advertising. Owing to the high return on ad spend, AMS has become a highly competitive platform. This has made managing AMS campaigns expensive and cumbersome. Businesses should be ready to invest significant time and effort in the AMS platform, adjusting their campaigns multiple times a day to capture customer identity and insights. This could be a daunting task but with the right technology, new campaign strategies will enable brands to obtain exclusive customer intelligence that is actionable. There are digital marketing experts who provide customized marketing platform solutions to enable Amazon sellers to make better decisions. They help advertisers maximize their ROI and make the best use of the AMS platform with automated analytics and recommendations.

Chart Sources :

- CIRP Estimates Sep, 2017 – Annual spending at Amazon

- eMarketer Sep 2017 – Net US Search Ad Revenues at Amazon 2016-2019

- eMarketer Sep 2017 – Net US Search Ad Revenues by Company 2016-2019

Read our post “Protect your Brand through Amazon Brand Registry” to learn how you can use this free service to safeguard your intellectual property on Amazon.