Over the last few months, Amazon’s Buy with Prime—once considered a relatively niche offering—has quietly popped up on DTC sites across the internet.

Most prominently, Adidas added Buy with Prime as a checkout option on its DTC site, a major show of support for the service. But other big brands, like Belkin, Fossil, Steve Madden, the YouTuber MrBeast, and so on have also recently rolled out a Buy with Prime offering.

Amazon is clearly taking Buy with Prime seriously. According to Retail Brew, Amazon is offering incentives to convince brands to add Buy with Prime to their websites.

That just underscores how much the new feature is becoming a priority for Amazon.

Why is Buy with Prime becoming so important?

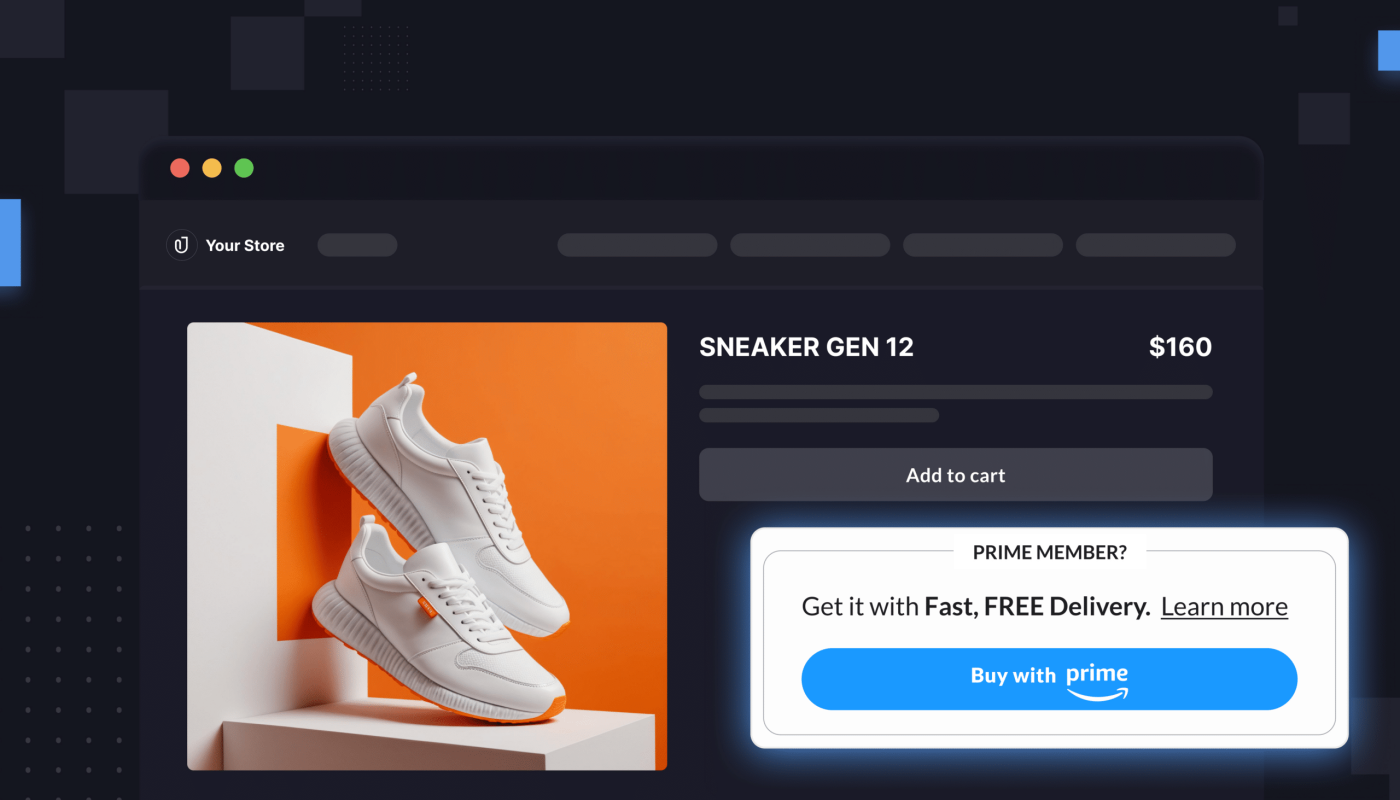

Buy with Prime is Amazon’s offsite checkout offering, where shoppers on a DTC site can opt to buy products through their Prime account and get their orders shipped through Amazon’s fulfillment system.

Don’t want to use Fulfillment by Amazon, however? Don’t worry: You as a brand owner have the option to use your own fulfillment system through Buy with Prime’s Multi-Channel Fulfillment option. You just have to maintain a Prime badge.

Brands keep all of the same data on their shoppers as they would if the shopper bought through Shopify.

When someone checks out from your DTC site using Buy with Prime, you as a brand owner get to see:

- Customer name and email

- Date of the order

- Total number and value for their Buy with Prime orders

- Total number and value of their returns through Buy with Prime

- Items returned and return amount

But the benefit, Amazon claims, is that Buy with Prime increases the number of conversions, since shoppers will be tempted by the free shipping through Prime.

Buy with Prime is now even integrated into PayPal checkout.

For Amazon, Buy with Prime has a number of strategic benefits. First, it helps the company forge relationships with traditional DTC brands, who may be leery about putting too many products in their catalog on Amazon.com.

Buy with Prime helps get them into the Amazon fulfillment ecosystem. It can also get them to buy more Amazon ads, as we’ll discuss shortly.

Buy with Prime also helps Amazon distinguish itself from its growing slate of competitors, like Temu, Shein, and TikTok Shop.

No other e-commerce platform can so closely tie together its ecosystem to a DTC site.

How does Buy with Prime encourage ads?

Amazon now has a whole slate of ads that point toward the Buy with Prime checkout option. Brands can pay for Amazon ads on platforms like Instagram and TikTok that point shoppers back to Buy with Prime checkout on their DTC site.

Because, through BWP, brands can keep all of the usual data on their shoppers, this is a very appealing use case of the service.

Most exciting, as we discussed last year, is Amazon’s Buy with Prime DSP ads.

This slate of ads, called Amazon DSP for Buy with Prime, makes it easier to use Amazon’s own data to drive shoppers back to your DTC site.

Buy with Prime DSP ads could, in theory, offer you the best of both worlds: You can use the labyrinth of insights Amazon has on its shoppers to fine-tune your DSP ad targeting. Then, you can send those shoppers to your site, where you maintain the customer relationship.

Think about those shoppers who have already been exposed to your brand in some way on Amazon. Maybe they added your product to cart on Amazon.com, but they haven’t purchased.

You can easily run a Buy with Prime DSP ad, send them to your DTC site, and keep more of the money and data on those shoppers than you would if they checked out on Amazon.

That’s great for you. And Amazon, meanwhile, wins either way. Amazon gets the money from FBA and the money that brands spend on those Buy with Prime ads.

Buy with Prime ultimately just encourages brands to go deeper into the Amazon ecosystem.

What is next for Buy with Prime?

Plenty of brands still, understandably, have skepticism about Buy with Prime as a service offering. But it’s important to grapple with the fact that Buy with Prime is unlikely to go away anytime soon.

Amazon increasingly seems less interested in ensuring that its shoppers never leave the Amazon app than in becoming the scaffolding—in terms of ads, logistics, discovery, and more—on top of which all e-commerce happens.

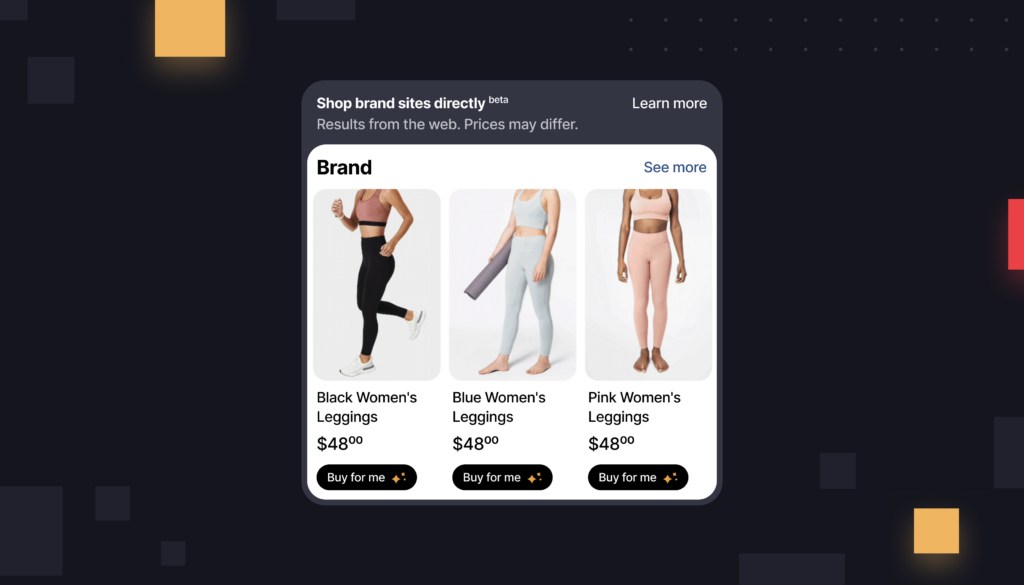

We’ve seen this with Amazon displaying non-Amazon buy links in the search results. As long as Amazon is integral to the customer shopping journey, perhaps they don’t care quite as much as we thought if the transaction actually happens on their platform.