Does your product content on Amazon need a refresh? Your titles, descriptions, and images are the backbone of your presence on Amazon. Paired with your price, they are the most important factors in determining whether or not a shopper makes a purchase from you.

But figuring out when is the right moment to do a content refresh isn’t always easy. If your product isn’t performing the way it used to, how can you unpack how much of the problem is content vs. advertising vs. market forces?

Frankly, it’s not easy.

Many software platforms, including Intentwise, can automatically audit and score your product detail page. Intentwise is able to suggest high-performing keywords that you didn’t put in your listing, for instance, to help you improve your content.

These tools are really great ways to self-audit your product detail page, and identify what needs changing and when.

But there are some other, less-noticed signals that can identify when your content might be becoming a roadblock to growth. We’re breaking down a few of those tactics below.

How do I know that it’s time to refresh my product page?

Remember: Just because a content strategy has worked well in the past doesn’t necessarily mean it’ll work well forever. The market might shift, and you need to shift with it.

Here are a few signals that the time for a big content refresh has come.

#1. Mismatch between revenue and ad performance

We’ll start with a slightly obvious one. Let’s say, over the last few months, your overall account revenue has started dropping. You can’t explain why. You check your ad campaigns, and your ad performance is still strong.

What could be going wrong?

Once you notice that there’s a mismatch between your ad performance and your overall account performance, you should consider whether the problem might be your content.

If your ads are performing well, that usually means something else is going wrong.

When the agency Clear Ads discovered that one of its top clients—a partywear brand—was seeing its revenue drop even as its ads were strong, studying its performance in Intentwise allowed it to figure out that the problem was likely the content.

From there, Intentwise made it easy to identify high-performing keywords that it should add into titles, bullet points, and descriptions across the brand’s numerous ASINs.

Being able to quickly audit these mismatches and identify the problems is why it’s so important to have your ads and your retail data in one view.

#2. Low New-To-Brand rates

If you find that your New-To-Brand rate is dropping, and there’s no clear seasonal explanation, you should probably take a second look at your content.

NTB data is easily accessible on the ASIN level through Amazon Marketing Cloud.

NTB rates are a good signal of whether or not your content is working. After all, shoppers who have never bought from you are paying close attention to your product detail pages.

They’re more likely to read everything—and click through all of your images—than shoppers who have purchased from your brand before.

Because the connection between NTB sales and strong content is so tight, you can usually take a declining NTB rate as a sign that your content needs updating.

If your NTB rate is dropping for a certain product, then you should think about images that need a refresh.

There are some caveats here, of course. Namely, keep in mind that NTB rates can have seasonal patterns. If you sell swimwear, for instance, you’re probably going to have a much higher NTB rate in the spring than in the fall.

Your NTB rate can also decline because of intentional advertising choices you’re making. If you switch up your ad spend to invest more in brand terms, for instance, then of course your NTB rate will be dropping.

But if your NTB rate is dropping over time, and there’s neither a clear seasonal nor advertising explanation, then you should be thinking seriously about the state of your content.

#3. Time to Conversion

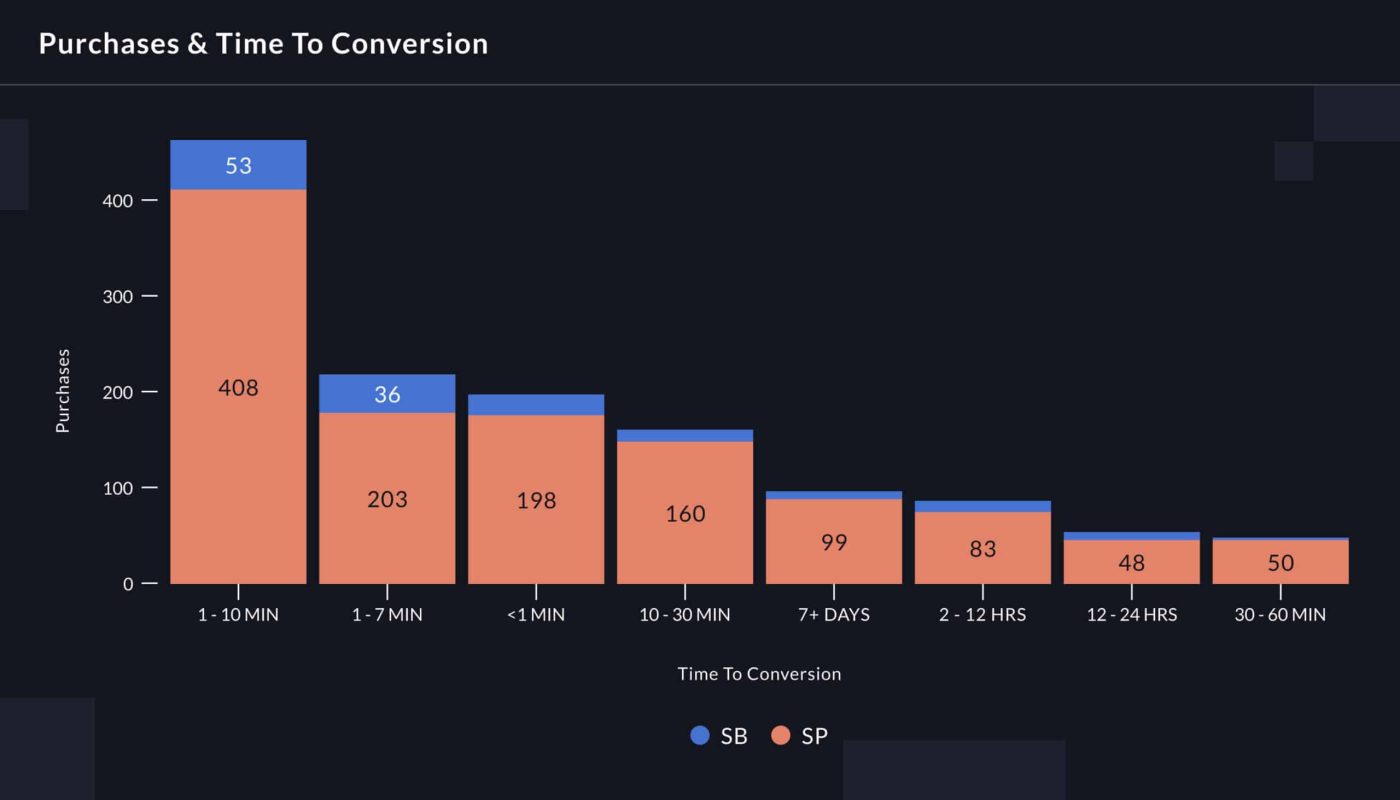

Here’s a bit of a counterintuitive way of auditing your content, but we like this use case a lot.

Basically: If the time between when a shopper clicks your ad and when they make a purchase is a lot longer than expected, then that might mean your content is getting in the way.

Time to Conversion is a dataset that’s available in Amazon Marketing Cloud. Users of Intentwise Explore—our solution for AMC—will see their Time to Conversion data automatically displayed every time they log in to our platform.

The problem is that “longer than expected” is obviously a bit of a vague target. As we’ve discussed before, not every product is going to have the same Time to Conversion.

High-price products, like jewelry, naturally have a long Time to Conversion. A box of granola bars, by contrast, should probably get most people converting within a few minutes of purchase.

Keep this context in mind when you’re evaluating your Time to Conversion. If you’re selling energy bars, and most people take an hour to buy from you after seeing your ad, that probably means your content is not the most compelling.

You can also get some sense of whether your content needs a big update by tracking your Time to Conversion data over time.

Say your Time to Conversion is actually increasing, and there’s no other explanation for why—e.g. your price didn’t increase. That probably does mean your shoppers are stumbling over something in your content.

Maybe your images or your product descriptions need a refresh.

Time to Conversion can’t tell you exactly what needs fixing, but it can be an important signal that an intervention is needed.

How do I build a more sophisticated content auditing operation?

We just walked through a few useful signals that you need to do a content refresh. The reality is, there are dozens more out there. Every agency and brand probably has its preferred signals to analyze.

But ultimately, it doesn’t matter which insights you use to determine whether your content is working. What counts is ensuring your data is automated, so you can watch these NTB or Time to Conversion statistics rise and fall at a glance.

Across the board, these signals are only useful to you when they appear automatically, at scale, across all of your ASINs. That’s why it’s so important to build a data strategy, and lean on a partner like Intentwise that can do this for you.