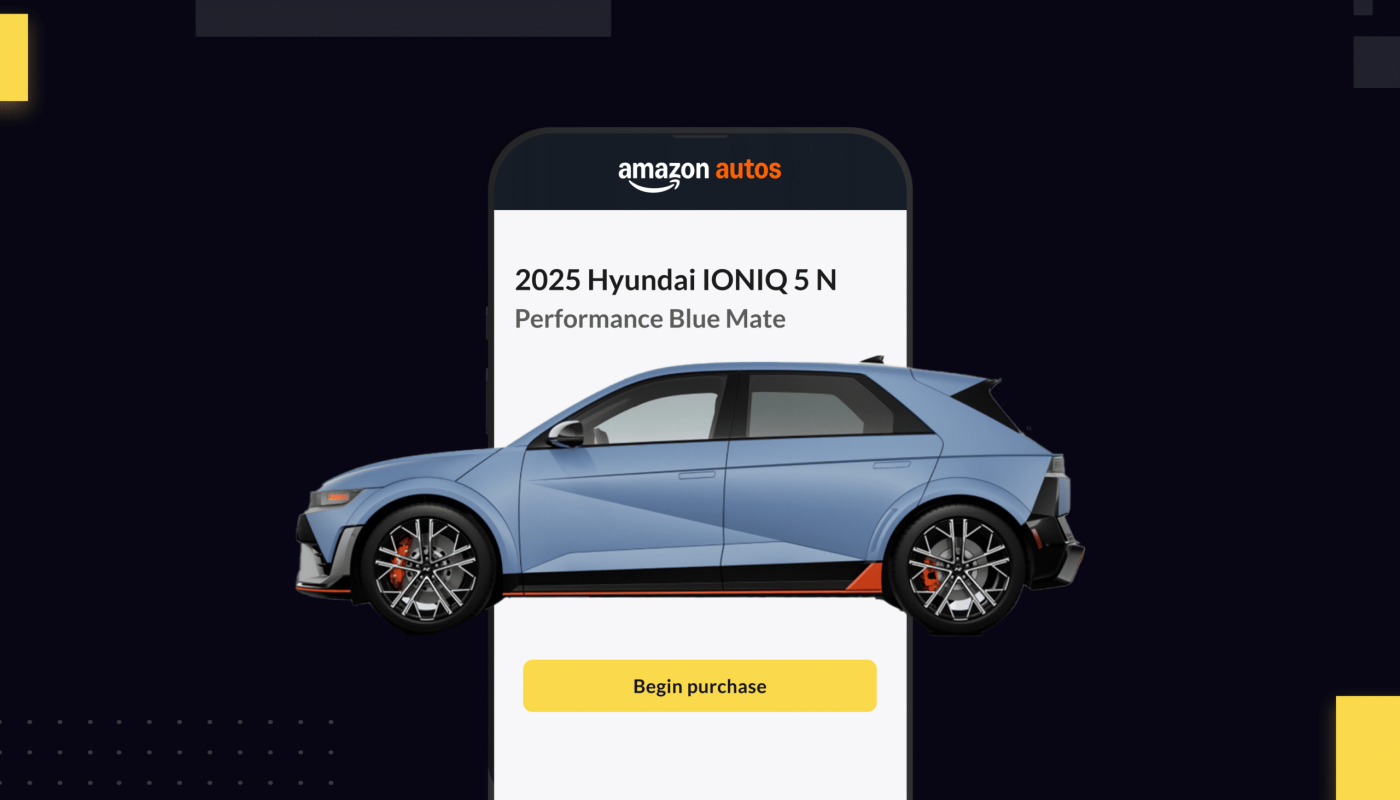

For the first time, Amazon is selling new cars to its shoppers.

Last week, Amazon announced a partnership with Hyundai dealerships across the U.S., allowing shoppers to search out new Hyundai cars and make a purchase through Amazon.

To do this, Amazon is partnering with car dealerships. Because of that, the Amazon checkout system is going to look a little different than the typical Buy Box purchase.

Instead, you’ll be filling out dealer paperwork.

So far, the trial is limited to just 48 cities, and is restricted to just Hyundai cars.

But it’s a big deal in the car business: Until this point, the primary e-commerce options in the market were focused on used vehicles (e.g. Carvana).

This shift is going to impact not just car dealers and brands, but everyone whose business even remotely touches the auto industry.

Whether you’re a brand that sells car charges or an Amazon agency that wants to represent more automotive clients, you should take this news seriously.

So today, here’s a brief overview of the state of the auto business on Amazon.

As a note: While this blog is focused on auto companies, it has a lot of lessons, we think, for any brand that sells on channels off of Amazon. Through what’s happening with vehicles, you can see how Amazon has become such an interconnected measurement tool.

What is the best Amazon ads strategy for auto brands?

Up until this partnership, Amazon has not directly sold cars. But it does sell a whole host of car-related products, ranging from car parts to chargers to paints.

Auto brands—regardless of whether they’re endemic or non-endemic—are a big part of Amazon’s current ad business.

For instance: Non-endemic car brands are significant buyers of Amazon DSP and Sponsored Display ads, especially on Thursday Night Football.

And companies that sell auto-related products on the Amazon platform (like car chargers) are always big spenders on Sponsored Ads.

Here’s how these brands should be strategizing their ad spend on Amazon.

They should leverage tools like:

In-market audiences. Amazon DSP has a built-in audience of shoppers who are in the market for a new car. You can filter based on the specific car brand they’re interested in.

This is a powerful audience not just for car dealers but for anyone who sells related products—chargers, insurance, car fresheners, etc.

If you know someone is looking to buy a new car, they’re probably in the market for a whole slew of related vehicle products, too.

Run highly targeted Sponsored Display and DSP ads. Seeing what products people search for Amazon can tell you a lot about what services they might be looking to buy.

If someone recently searched for “yoga mats” on Amazon, for instance, then they are probably a very good candidate for your subscription.

The same is true for cars. If you know someone just bought a car, all kinds of businesses—insurance companies, repair companies, oil companies, etc—are going to want to advertise to them.

As Amazon starts selling vehicles, it’s going to be easier than ever to reach these specifically targeted audiences.

For endemic brands in the car space, like a motor oil company, bid boosting through Amazon Marketing Cloud for Sponsored Ads might be especially useful.

Using AMC, you can easily boost your bids across your ad campaign on shoppers who you know purchased a car in the last 3 months.

They’re probably a lot more susceptible to buying your motor oil than everyone else—and it’s worth it to automatically spend more reaching these shoppers than any old keyword searcher.

(Confused on how this works? Be sure to download our new AMC for Sponsored Ads whitepaper.)

Geotargeting. Car sales are a heavily regional business—as are a lot of insurance, finance, or brick-and-mortar businesses.

You want to target shoppers differently depending on the region they’re from. You also want to be sure you aren’t wasting people who are not in your main geographic market.

(Think about a car dealer: Your customers will inevitably be from a tight radius of your store.)

Luckily, DSP advertisers can specifically include or exclude shoppers based on geography in their ad campaigns.

In Amazon DSP, you can narrow down your custom audiences based on:

- State

- City

- Media market

- Zip code

You set geo locations at the Line Item level. You can either include or exclude audiences based on geo-location.

AMC Vehicle Purchase Insights. The biggest question for non-endemic brands on Amazon, of course, is measurement. How many of these ads are actually driving sales?

This is especially hard to measure for high-price products like new cars, where the time to purchase is likely quite long and the conversion rate is inevitably going to be lower than for, say, a basic household product.

One big benefit of Amazon’s new Hyundai partnership is it offers a workaround. The participating Hyundai dealers now will be able to more directly map their ads to actual purchases.

But what if you don’t sell Hyundais? You can still track the actual impact of your Amazon ads. In AMC, one of the Paid Features that many brands use is the Experian Vehicle Purchase Insights subscription.

This data set connects Amazon ad interactions to actual car sales.

With Experian Vehicle Purchase Insights, you get:

- Ad-attributed purchases: AMC can help you tie a shopper who saw an ad or who engaged with your brand on Amazon to an offline vehicle purchase. It doesn’t matter if they use Amazon checkout.

- Path to purchase: What are the ads or other brand engagements that your shoppers saw before making their purchases?

- Audiences: Identify the audience segment that is most likely to purchase your vehicle as compared to a rival’s. Also, run ads to any audiences you want.

What automotive audiences can I make on Amazon?

The audience-targeting component matters not just for car dealers or brands but also for anyone in the automotive space.

A motor oil company might create an audience of shoppers who recently purchased a car, and run Amazon ads to them. A non-endemic car insurance brand might do the same.

Or, let’s say you’re a brick-and-mortar car wash. If you see someone in your area just bought a car, you might run an ad after 3-4 weeks touting your store.

What are the lessons of Amazon’s automotive play?

Amazon’s foray into the car business makes a lot of sense in light of its growing sports streaming business. Cars are a major advertiser of sports games, especially the NFL.

By offering vehicles for sale directly on its site, Amazon can show brands a truly one-of-a-kind view of their path to purchase.

A shopper who sees a Hyundai ad on Amazon’s Thursday Night Football stream and then buys a car from the site will be traceable with previously unimaginable granularity.

This feels like the future of Amazon—not just for automotives, but for everything.