These days, differentiating yourself on Amazon is all about audience segmentation. In just the last 12 months, Amazon has made it possible to get far, far more specific about who sees your ads.

Done right, audience segmentation will lead to more efficient ad spend and much more personalized marketing tactics.

Let’s rewind for a second. Just six months ago, for Sponsored Ads, you could only reach shoppers based on keywords they searched, like “coffee machine.”

Everyone who searched that term would see your ad.

The upside is that you got in front of a group of shoppers who were close to purchase. But not all of those shoppers are equally relevant to your brand. Amid that group of “coffee machine” searchers, some are more valuable than others.

The problem was, you couldn’t add extra dimensions to that ad campaign. For instance, you couldn’t target people who have already viewed your product page differently than those who have not.

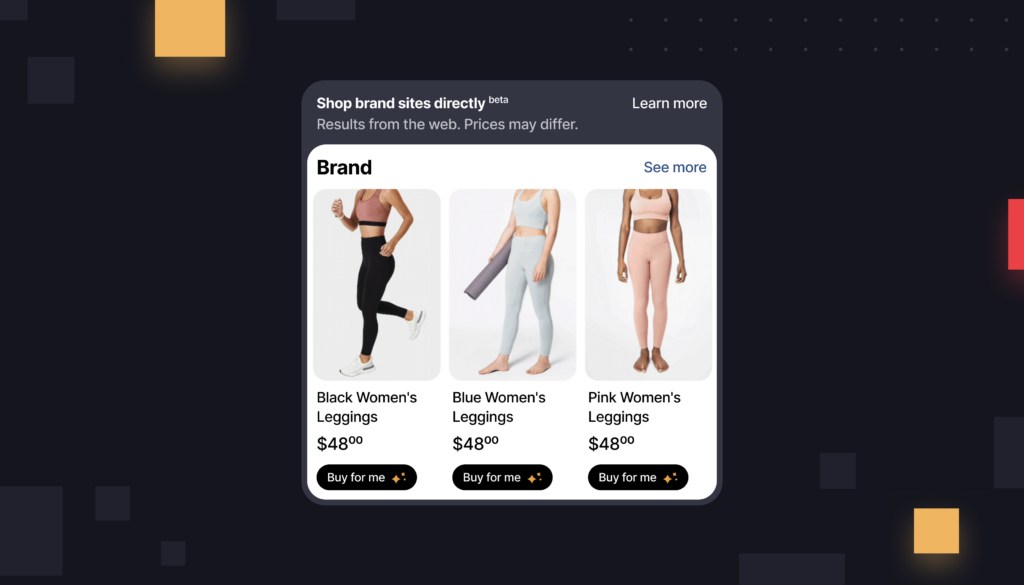

That has all changed. Now, you can layer your Sponsored Ads and DSP campaigns with virtually any information you want.

Run a Sponsored Display ad specifically to shoppers who have high or low spend, who have taken certain actions or searched specific terms in the past, or who have visited your first-party website.

Or, through Sponsored Products and Sponsored Brands ads, you can boost your bids for those audiences specifically.

All of this happens through Amazon Marketing Cloud.

Really, audience segmentation has quietly become the simplest way to level up your marketing strategy—and get more efficient on your ad spend in the process.

Segment audiences based on recent keyword searches

Here’s one simple audience segment we are really loving right now: Go after people who searched for a high-intent keyword of your brand, saw your ad, but didn’t click.

Remember, the vast, vast majority of shoppers who search your high-intent, non-brand keywords on Amazon are not clicking on your ads.

Say you sell a dual coffee maker. People who search “dual coffee maker” on Amazon are excellent potential customers for you, but 97+% of the time, they’re simply not going to click your non-brand ad.

That’s why re-targeting shoppers based on their recent searches is so valuable.

You can easily create an audience of people who recently searched “dual coffee maker” and still haven’t purchased, and target them with a DSP or a Sponsored Display ad.

Specifically, we think this works best for shoppers who saw your ad but didn’t click on it.

The one note of caution: You should only bother to do this targeting with keywords with enough impression volume, so this tactic will only be useful for a limited set of high-intent, high-volume keywords.

You can also add more layers to this audience if you need to.

Crunch the numbers on how many of your keywords have a big impression. If it’s still a lot of keywords, you can narrow the scope by adding an overlay of, say, ASIN viewing data. So you can specifically target people who searched your non-brand term and either did view your product already or did not view your product already.

With AMC, it’s easy to add these overlays to your audience to get as granular as you need.

Other top audience segments to build

Here are a few other audience segments that our clients have used to stand out.

Value-based audience. We’ve written about this before, but one of the most exciting new audience segmentation tactics is to bid differently based on the life-time value of a shopper.

A shopper who spends a lot on your brand—or who you expect to spend a lot on your brand—offers a fundamentally different value proposition than one who doesn’t.

Our clients often create high-value audiences based on either purchase value or repeat purchase behavior. We’ve seen great results—ROAS increases of over 25% and clickthrough rate increases of 15+%.

The one complexity here is that most brands have a slightly different definition of high-value shoppers. Maybe you measure it based on percentile, maybe you measure it based on raw spend, or maybe you use repeat purchase data.

For what it’s worth, in Intentwise Explore we have a lot of pre-built value-based audiences, and you can easily customize them in our platform based on what “high-value” means to you.

Tentpole event re-targeting. AMC helps you get a lot more mileage out of your tentpole events.

Let’s say you’re preparing for Prime Day, for a holiday, or for a peak sales period for you. You can now easily re-target (or exclude) audiences who bought from you the last time around.

Because you can now add a time dimension to your past purchasers, it’s easy to reach shoppers who bought from you during last year’s Prime Day, or who viewed your brand but did not purchase.

You can also create lookalikes of this audience. Deciding who you want to reach on the next Prime Day? Creating a lookalike of your Prime Day shoppers from the year prior is a great place to start.

5-year historical datasets. And here’s an exciting update: Last month, Amazon announced a significant expansion of its targeting capabilities.

Remember, currently all Amazon Marketing Cloud data sets have a default 12.5-month lookback window when you sign up.

You can build up your historical data by activating your AMC instance and letting it run, of course. But your lookback window when you first join is only a little over a year.

Soon, however, AMC is rolling out an entirely new data set—called amazon_retail_purchase—that includes the entire purchase history for your brand for 5 years.

It’s a major expansion of your historical data, and once it rolls out of closed beta, we think it’ll open up a whole new universe of audience segments.

Think about it. With this 5-year data set, you can more easily create shopper audiences based on the frequency of purchase or the value of their spend to you, or you can try to re-engage inactive shoppers.

You can also get much smarter about your New-To-Brand shoppers.

By default, Amazon counts anyone who hasn’t bought from your brand in the last 12 months as New-To-Brand. But obviously, some of those shoppers will have purchased from you—just more than a year ago.

With this data set, you can see who is truly New-To-Brand, and get much more granular in your strategy. Someone who bought from you 18 months ago probably needs a different marketing tactic than someone who never purchased from you, for instance.