The Amazon advertising/retail media management industry is growing by leaps and bounds, and is an exciting new advertising channel. Amazon in just a few short years has become a major player in advertising, and its consumer media optimization capabilities have improved dramatically over time.

In the past few months, many of my conversations have been geared around Amazon’s Media Platforms, overall ecommerce data strategies, and effective media optimization strategies within Amazon and the emerging plethora of other retail marketplaces too (Walmart, Instacart, etc). I’ve also been really interested to notice where people in this industry previously came from. As an example of two camps of people professional backgrounds I’ve seen:

1. People who are ‘native’ to Amazon and Retail Media management. They grew up in industries such as shopper marketing, retail media management, or are native to the Amazon ecommerce industry.

2. People who previously had experience in other digital performance media channels such as search-engine marketing or programmatic DSP buying and now have moved into the Amazon/ecommerce space.

I personally fall into the latter category. As a 20-plus-year digital performance marketing industry veteran, I’ve lived through the early days of each of the major digital performance marketing ‘waves’ from email marketing, affiliate marketing, display advertising, SEM, social media, programmatic DSP, and now Amazon and the emerging retail media marketplaces.

For people that came from other performance media channels, it’s interesting and important to understand at a high level some of the main differences between historical digital performance media channels and the digital retail/ecommerce industry. Here are a few thoughts on key differences:

1. Advertiser’s control of messaging

In traditional digital marketing performance media channels like Google and Facebook, the advertiser has complete control over the shopping experience post-click. In sharp contrast, the Amazon platform owns the post-click experience in online retail commerce, and this dramatically increases complexity for brands and their agencies. One effect of this difference is the Amazon practitioner has many more ways in which to impact buyer behavior, including a variety of different shopper-centric signals (to be discussed next) and even has at their disposal Amazon Retail Operations data. This is data that Amazon makes available such as sales and advertising performance metrics.

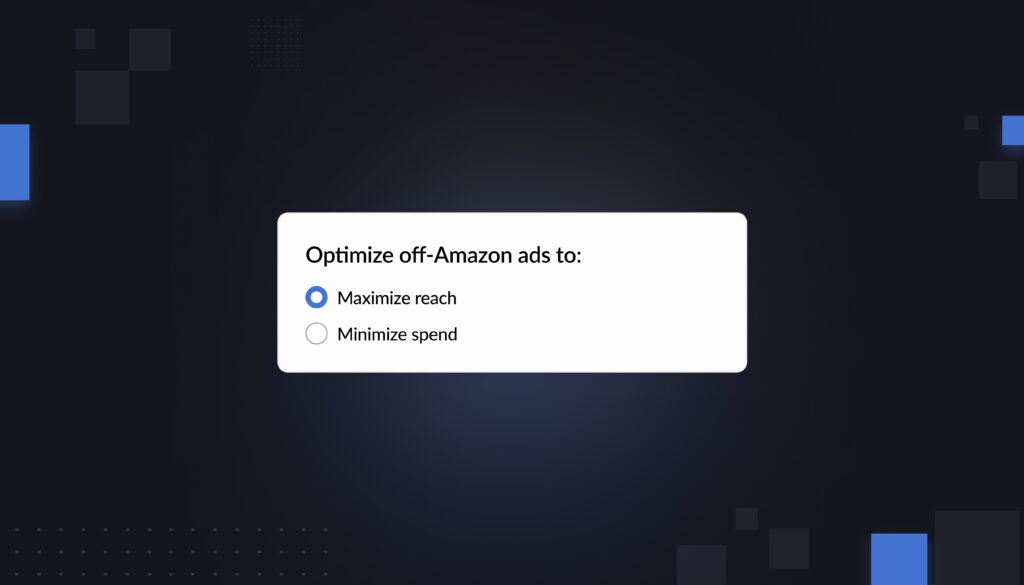

2. Media Optimization combines both advertising and non-advertising shopper-centric signals

Unlike Google and Facebook media buying, non-advertising factors such as inventory levels, pricing, competitor proximity, and reviews influence campaign performance in dramatic ways. For example, enabling ads for products based on inventory levels is an important media optimization tactic (connecting Ads & Inventory).

3. The Amazon intertwined nature of organic and paid media

With Google, SEO (organic) and SEM (paid) advertising can be very separate media optimization activities. But this isn’t true for Amazon. Within Amazon’s media optimization mix, paid and organic drastically affects each other, and both need to be holistically considered when figuring out a brand’s media optimization strategies and tactics.

4. Different people resources and training needed

Senior marketers at brands and agencies who manage company people resources need to understand the training and resource nuances of Amazon/ecommerce versus traditional digital performance channels. In the past, when the social media marketing wave hit or the programmatic DSP buying channel emerged, I saw a lot of brands/agencies simply move their ex-SEM professionals into these new performance channels. And for the most part, the learning curve for these ex-SEM professionals wasn’t very steep.

This isn’t necessarily the case with moving ex-SEM professionals into Amazon media buying. To win the Amazon/ecommerce performance media game, as mentioned before, the practitioner needs to take into consideration other non-advertising optimization factors such inventory levels, competitors pricing, badging, reviews, delivery dates, and organic ranking, to name a few. Hence, brands/agencies need to have a different set of resource skillsets working on Amazon Media activities and be prepared to invest in training their practitioners in understanding the holistic set of variables that affect media optimization performance.

5. Usage of ecommerce ad optimization technology

It’s still the early days with Amazon in their ongoing development of practitioner toolsets compared with more mature and sophisticated tools available for Google, Facebook, or other Programmatic DSP ad platforms. Because of this, Amazon/ecommerce practitioners need to review and consider a new set of Amazon media optimization and data platforms to improve upon advertising results and reach new customers.

Certainly, these are only a few of the major differences between historical performance media channels and this new Amazon and Retail Media marketplaces ecosystem. I’d love to hear from others who came from the SEM or Programmatic DSP buying space and hear your thoughts on other similarities and differences.