What is the Amazon Brand Store Insights subscription? Amazon just released a new data set that can dramatically improve how you analyze the performance of your Brand Store.

Announced last week, Amazon is adding a Brand Store Insights subscription as the newest Paid Feature available in AMC.

This Brand Store Insights subscription gives you a much more granular look at your Brand Store than has ever been possible.

Here’s what it can do—and how to think about whether it’s worth the money.

What are Paid Features in Amazon Marketing Cloud?

First, a quick review: What are Paid Features? We’ve written about Paid Features in AMC a few times before. We recommend checking out our blog posts if you aren’t familiar.

But to keep it simple: AMC by default only shows you ad-attributed data sets. If you want more data, AMC’s Shopping Insights gives you all organic events, so you can calculate Life-Time Value.

AMC also has other niche insights, like in-store purchase insights and vehicle purchase data.

Brand Store Insights is the newest addition to that rich portfolio.

Why bother with Amazon Brand Store insights?

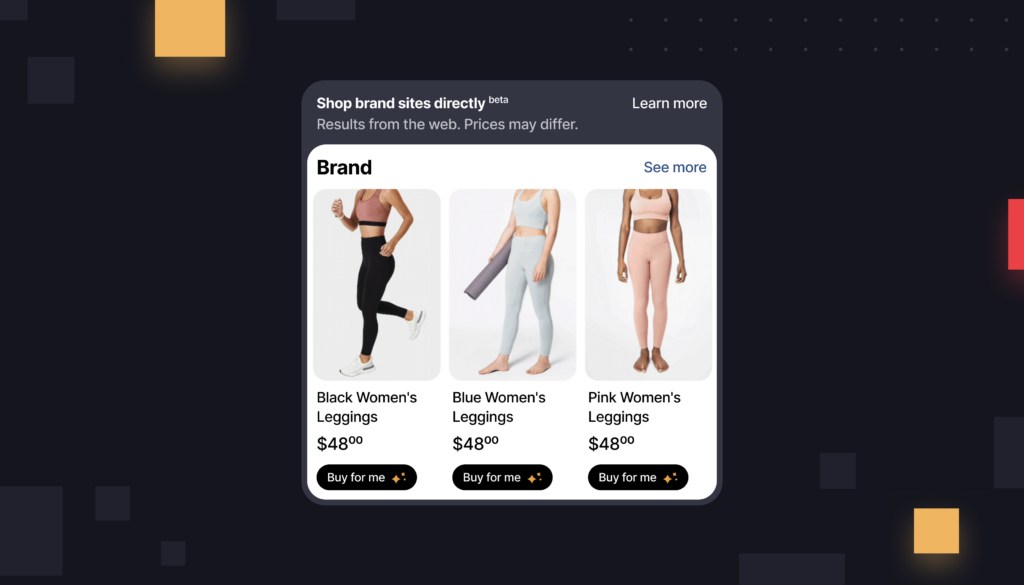

Your Brand Store is a big deal. It’s the place where many shoppers learn about your overall business: Your Sponsored Brands ads direct people back to your Brand Store. People also find it when they search it on Google.

And as we discussed recently, brand building is now the key to success on Amazon.

No matter the size of your brand, you don’t want to avoid investing in your Brand Store.

The big question has always been, how can you use data to get more sophisticated about your Brand Store strategy?

Brands have access to a limited set of Brand Store analytics, as we outlined in a recent webinar. You can measure the conversion rate of your store, for instance, or track the dwell time (time that shoppers spend on your store).

If your conversion rates are low, you might consider swapping out the products you feature on the main page.

But Brand Store Insights takes this up a notch. The new subscription makes it possible, for the first time, to track exactly how your Brand Store fits into your wider marketing strategy.

With this data set, a visit to your Brand Store will now show up on the Path to Conversion analysis that you run on AMC.

As you may know, AMC’s Path to Conversion analysis lets you see which sets of actions a shopper takes before purchasing. These often involve ads: You can see which set of ads a shopper saw, e.g. a typical path might be SD —> SP.

With the Brand Store Insights data set, “BSI” will show up as an event along the Path to Conversion.

These new insights will let you see how well your Brand Store is actually working. You can, for instance, run a query that compares the conversion rate (or perhaps average order value) of shoppers who visited your Brand Store versus those who didn’t.

If the Brand Store cohort doesn’t perform notably better than the non-Brand Store cohort, that suggests your Brand Store isn’t bringing much of a value add. It might be time for a refresh.

What other tactics can Amazon Brand Store Insights offer?

In Brand Store Insights, AMC logs other data that might prove useful, including a column called “ingress_type” that breaks shoppers into groups based on how they found your store (search, ads, clicking your byline, etc).

You could use a column like this to see how a shopper’s likelihood of converting varies depending on how they first found your Brand Store.

Do shoppers who found your Brand Store through your detail page behave differently from shoppers who clicked into it from a Sponsored Brands ad? Now you can find out.

Or you can go deeper, too. Let’s say you’re trying to refer a lot of external traffic back to your Brand Store, as many marketers are these days.

You can now see exactly how well this is all working with the referrer_domain column, which displays the URL that every shopper came to your Brand Store from (google.com vs. tiktok.com vs. amazon.com).

In theory, if you’re AMC savvy, you can break your shoppers into different groups based on which external URL referred them to your store. Do visitors from TikTok.com behave differently from visitors from Google.com?

And once they stumble on your Brand Store, what do they do next? What do they buy?

Can you create audiences based on Brand Store interactions?

The other good news: You can now use Brand Store interactions to create new shopper audiences for Amazon. At the simplest level, you can now create an audience of shoppers who already saw your Brand Store, and export it to your DSP or Sponsored Ads campaigns.

This is a great potential use of bid boosting: Imagine, for SP and SB ads, you increase your bids on every shopper who has recently visited your Brand Store.

It’s all very exciting—but it, of course, comes with a cost.

The level of granularity available in Brand Store Insights isn’t going to be necessary for everyone. If you don’t have much budget to spend on enhancing your Brand Store, you don’t need to bother spending more to analyze how it’s doing.

But if you do find that your Brand Store is becoming a major part of your strategy, as it is for many brands, the analysis of your performance you can get from Brand Store Insights would be a powerful tool in your arsenal.

The audiences, too, let you just get a lot more granular.

![[Brand Store Insights] Blog Post [Brand Store Insights] Blog Post](https://www.intentwise.com/blog/wp-content/uploads/elementor/thumbs/Brand-Store-Insights-Blog-Post-scaled-r3tid5c7k8q647fudgc97qdhg6az6tuh7l5gsdpdfk.jpg)