Do you ever wonder whether you are, unknowingly, making some small oversight in your ad campaigns that is costing you revenue?

Amazon is so complex. Especially as the Fall Prime Day approaches next week, you may want to know: What if you’re skipping a key tactical step?

Chances are, you probably are. At Intentwise, we work with thousands of clients every day, and we see that even very sophisticated advertisers are sometimes missing out on best practices.

A core feature of Intentwise is our proactive Recommendations Engine, which analyzes the accounts of our customers for missed opportunities, gaps, and errors. Every day, Intentwise customers apply thousands of new recommendations to their account.

We realized this data might be valuable to our readers, too. So we sat down with our team to understand which missed opportunities we see most often in customer accounts—and how brands and agencies can avoid them.

Below, we compiled the top three most-applied recommendations on our platform. If you want to know where you might look to optimize your ad campaigns, start here.

The most common campaign recommendations

According to Intentwise’s internal data, here are the top three most actionable campaign oversights, listed in order.

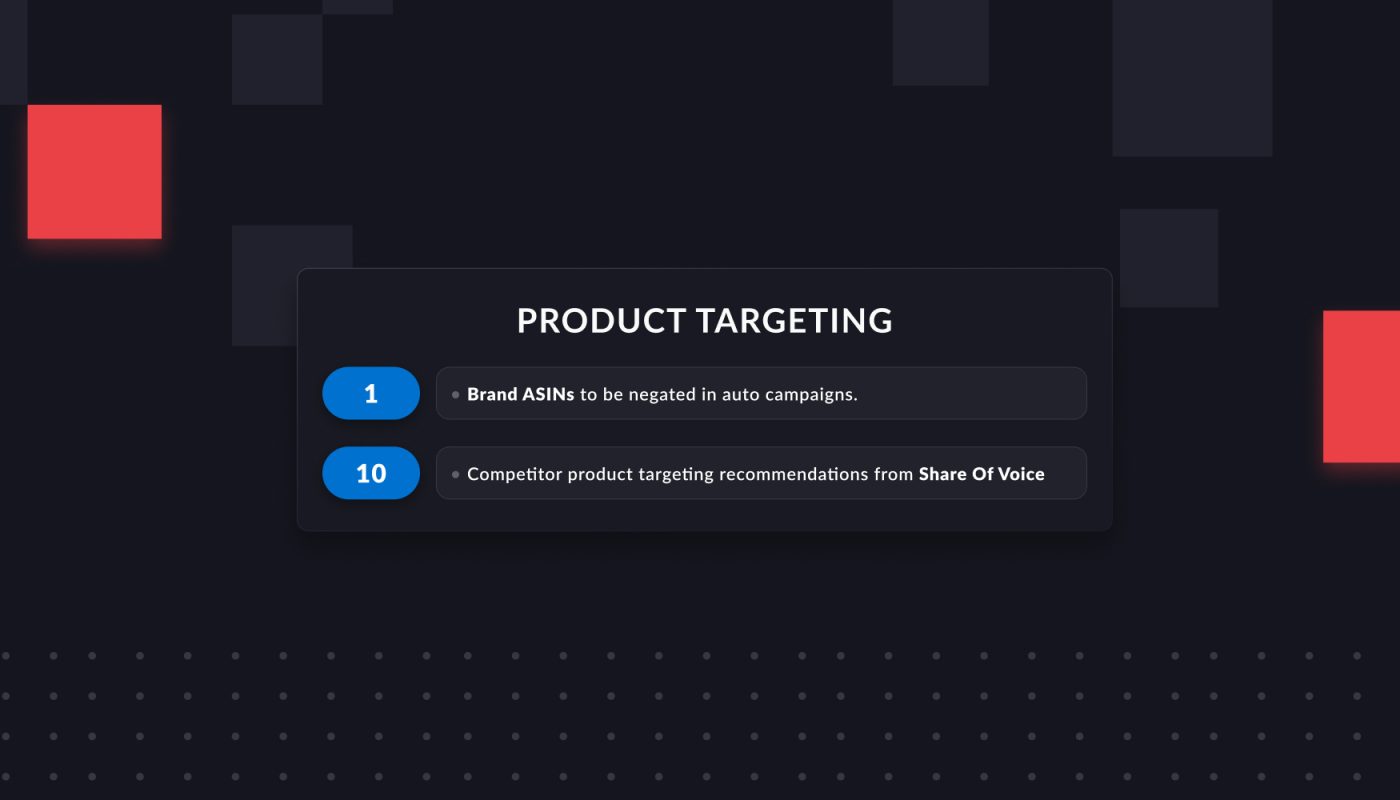

#1. Brand terms triggered in auto campaigns

When you run an auto campaign on Amazon, Amazon surfaces your ads on keywords (within your budget) that it thinks are relevant to your product.

Amazon looks at the keywords on your product page, the purchases customers make after viewing your product, and many other factors to determine relevant keywords for your ad.

Sometimes Amazon will show your ad on keywords that include your brand name (“Bose headphones”).

The problem? Your branded terms are inherently going to have a much better ACOS than your non-branded terms. So the introduction of branded terms might inflate how well your auto campaign is performing.

You could be losing money on an auto campaign—but because the branded terms are masking those failures, you wouldn’t even know.

At Intentwise, our platform flags these terms automatically, but you could also do it by hand in your Search Terms Report.

Don’t want branded terms to show up? The solution: Create negative keywords to ensure they don’t surface in your campaign.

#2. Competitor product targeting based on Share of Voice

Your Share of Voice is essentially the percentage of search result real estate your products occupy.

Share of Voice tells you how your brand is performing for your search terms. But it is also a critical way to find competitors to target.

How does this work? Just examine competitor products that are very similar to yours and that show up for similar keywords, and then run ads against them.

Share of Voice data can surface a wealth of product targets to add to your campaigns. It’s the best way to kickstart a more aggressive competitor targeting strategy.

But too often, we’ve found in our data, brands overlook this strategy of targeting competitor brands with high overlap.

The Intentwise Share of Voice module allows you to enter keywords and ASINs you want to track. From there, it collects valuable information about the search results—including organic and sponsored rank, price, reviews and review quality, competitor brands, and much more.

Intentwise’s Recommendations Engine is constantly analyzing your SOV data in search of new competitor ASINs to target. Our Recommendations Engine recognizes products that frequently show up next to yours, but over which you have a competitive edge.

A product that has high overlap for yours, but where you have a more favorable price or rating and review count, is then suggested as a target.

If you wanted to leverage Share of Voice without a platform like ours, you could take a similar approach. Identify competitor products that overlap on your core search terms, but which have, say, a higher price than your product. Then add them to your targeting.

You would just have to do this manually.

#3. Product targeting suggestions from search terms

Along similar lines, our third most-applied campaign recommendation shows you how to pull lucrative product targets out of your search terms. These ASINs can sometimes be hidden in your search terms report, especially if you are running a lot of auto campaigns.

Comb through your top search terms, and pick out other competitor ASINs that are generating a high share of impressions or incurring significant amounts of spend.

Product targeting based on your search terms data is smart, because it gives you a second chance to steal a sale from a brand.

Even if the shopper ends up clicking one of your competitor’s products, with a product-targeted ad, the shopper could still make their way back to you.

Without Intentwise Ad Optimizer, however, this is a manual step that you have to repeat again and again to ensure you don’t miss any ASINs.

What’s our big takeaway from this research?

First, a caveat: Just because an automated system like Intentwise recommends a particular action doesn’t mean you should accept it without question.

We always encourage brands to think through, say, a product target recommendation before they activate it. Examine the CPCs, ACOS, and other data points before you activate a recommendation.

Automated recommendations are meant to be thought starters more than they are set-in-stone rules.

That said, you should be getting regular campaign optimization recommendations. No matter what, you need to have some built-in way to audit your campaigns.

That’s especially true now. Amazon ads are becoming more complex by the day. On one hand, that’s great because the potential is so high. On the other, it leaves open the door for even an experienced advertiser to make some obvious oversights.

We talked recently about the many wonky segmentation issues that can happen, almost inevitably, when you run ads on Amazon. There are also always powerful product targets and keyword targets that you risk leaving on the table.

So how do you do this? It starts with organizing all of your data points into a simple, refreshable dashboard. Then, run regular evaluations—either by hand or in an automated way—to quickly identify campaign oversights.

And if you aren’t sure where to start, we think the top 3 most-applied recommendations in the Intentwise platform offer a good baseline.