To understand the impact of Amazon Marketing Stream (AMS), it’s first necessary to understand the difference between a push versus a pull of data. Without AMS, advertising data was only as timely as the last time data was pulled. With AMS, data is published on an hourly basis, and advertisers can subscribe to have those updates pushed to them.

AMS, which is in an “open beta phase,” was only launched in June, so it’s still a work in progress. Today, AMS is only available for Sponsored Products in the United States, Canada, and Mexico, and only includes advertising data, not retail data (yet). Nevertheless, AMS fundamentally changes how often advertisers can see their data, which opens up many new possibilities for ad optimization.

The basics: the two types of AMS data

The information available in AMS breaks into two categories: reporting data, which highlights campaign performance such as hourly traffic and conversion data by keyword/target and placement; and messaging, such as real-time notifications on budget consumption. Currently, AMS data includes:

- Sponsored Products traffic

- Sponsored Products conversions

- Sponsored ads budget usage

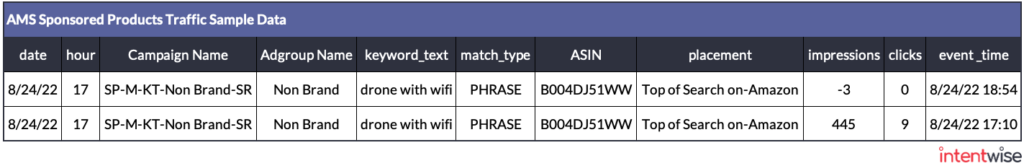

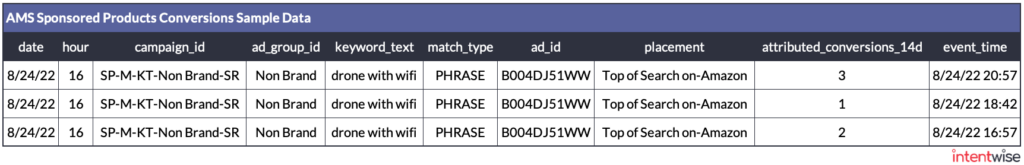

Below, I’ve included sample records from each of the three datasets. One quick note: the sample data is a representation of real Amazon data, and the column names have been adjusted to better illustrate the types of data in plain language.

Here’s an example of AMS Sponsored Products traffic data.

Advertisers can receive changes/updates to data from previous hours throughout the day. For instance, the negative value for impressions in the record above indicates that it is an update to the impression metric for the 17th hour.

And here’s what AMS Sponsored Products conversions data looks like:

As always, conversion data is click-attributed, which means as shoppers convert, those conversions are tied back to their original ad clicks (and the hour of the click).

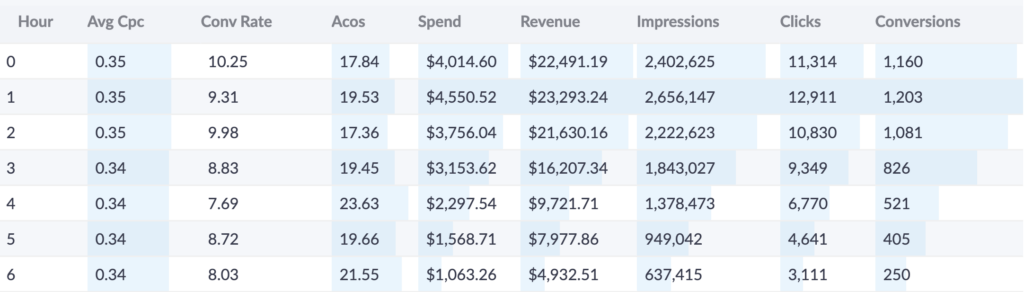

Combining the traffic and conversion data gives us efficiency metrics such as conversion rate and advertising cost of sales (ACOS). Here’s what that looks like in practice in the Intentwise platform:

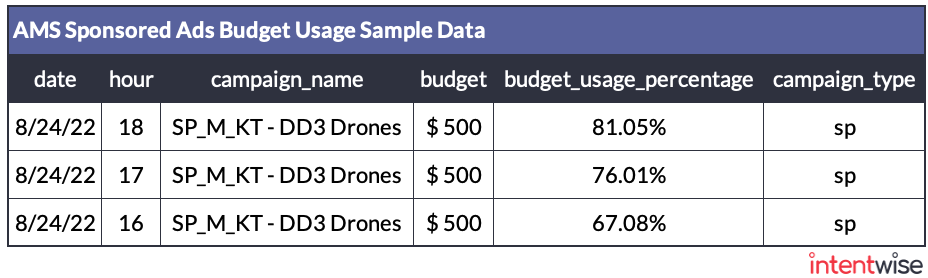

And finally, this is an example of AMS sponsored ads budget usage data.

Amazon notifies advertisers at 5% increments in daily campaign-level budget consumption.

Watch hourly data, but be mindful of conversions that come in later

One of the perks of AMS is that advertisers can now observe hourly data (also known as intraday data), such as cost-per-click (CPCs), ACOS, and conversion rates throughout the day. As I wrote earlier this month, we’ve already observed that CPCs decrease dramatically towards the end of the day, suggesting a key learning: campaigns may be running out of budget. There are two simple ways to handle this: raise budgets or lower bids.

But proceed with caution when evaluating conversions-related data. For example, let’s say a shopper clicks on an ad for dog food when they notice they are running low at breakfast, but don’t actually purchase the advertised dog food until their lunch break at work. The hourly data at breakfast does not show the purchase at lunch. This means even though the data is hourly, conversion rates and ACOS must be looked at over longer periods of time to find actionable patterns.

Putting AMS to use in bid management

Advertisers can use this hourly data to set up systems for success. If an advertiser is using rules-based automation to manage bids, they can set up day-parting based on patterns in AMS data. If they are relying on artificial intelligence/machine (AI/ML) learning–based algorithms, these algorithms can incorporate hourly AMS signals and change bids intraday as necessary.

AMS is a new, beta offering, so Amazon will likely continue to improve, refine, and expand what it can do. I expect this will include expanding the supported campaign types into Sponsored Brands and Sponsored Display. Amazon also plans to “expand the messaging to include notifications about product eligibility, bid recommendations, and other events.”

What’s new here, really?

If you are like me and have been in the search advertising world for a while, you might be thinking, “What is the big deal here? Google and Facebook have been sharing hourly data for a long time now.” I agree, partly. While the hourly data provides additional granularity into advertising performance, what is really new here is the “messaging” data offering notifications of events, like a campaign running out of budget, as they occur.

I have long touted that advertising performance on Amazon is heavily influenced by retail factors. If I take a “crystal ball” view and speculate, this could mean a world where Amazon notifies advertisers in near real-time as some key events occur, such as products going out of stock or prices changing. The potential for these notifications starts to get super interesting, and it could move ecommerce advertising a lot closer to executing on the idea of “retail-aware ad optimization.”

Interested in learning how Amazon Marketing Stream can improve your advertising? Book an Intentwise demo.